Disruption in the UK Consultancy Sector

The Consultancy market in the U.K has been a fascinating place in which to operate over the last few years. The sector is going through, and will continue to go through, a large period of disruption and this blog will attempt to shed some light on some of the primary trends relating to disruption with some current examples of these trends impacting the ecosystem.

Disruption in the Consultancy sector has arrived in many forms but recent research by Mavenlink suggests three key pillars on which this change is centred – Client Demands, Competition and Resourcing Models.

In preparation for this piece, I used the trends identified by Mavenlink as a basis on which to ask some of Investigo’s network to bring the hypothesis to life as much as possible. I asked 40 Partners in Consultancy if, over the last 5 years, they have noticed a difference in their clients’ demands. Over 75% of the Partners I asked suggested overwhelmingly that clients (P.E execs and FTSE 250 execs in the main) are looking for higher value-add or impact from their teams, more sector or functional expertise vs generic consulting skillsets and rather counter-intuitively, an increased speed of delivery mixed with more discounts on rate cards! The remaining 25% either disagreed or didn’t seem to want to comment on their clients – despite the promise of anonymity…! These client demands are putting pressure on the Consultancy sector to change their business models and career progression criteria. It’s no use entering the boardroom with a brain the size of Jupiter and a PhD in Powerpoint unless you have something relevant to talk about which connects an exec to their problems/opportunities in real-life terms. This is encouraging most sector-agnostic consulting firms to build sector-focused teams to please sector-focused clients. Naturally this trend plays into the hands of smaller boutiques who often pin their flag to a sector and have the ability to budge on price-points with a lower back-office cost base.

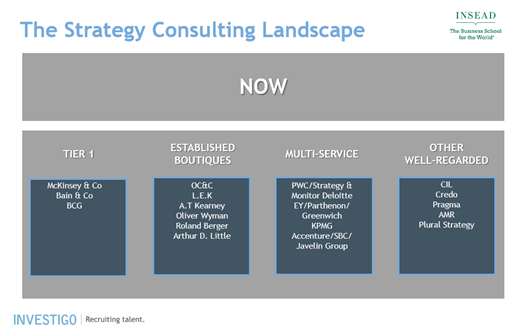

This leads nicely onto the second point identified by Mavenlink – Competition. There is a well-versed view across most Consultancy sector execs that the competition has increased – perhaps driven by the above – in recent years. Below I’ve shared two slides that I used at a presentation on Strategy Consultancy to an MBA class at INSEAD a few years back which supports my personal view that the quantity of competition is decreasing but the quality of competition is increasing (this is not an exhaustive list and is not meant to offend any respected firms that are not mentioned!). There is a third slide which makes a prediction on the state of play in 3 years from now - I’ll keep that one to myself for the time-being but happy to chat about it if you would like to.

Consolidation in the Consultancy sector has been a driver of disruption in the industry. As the larger global firms with large balance sheets look to upskill their capabilities in the form of targeted acquisitions in order to increase their presence in the boardroom, some of the traditional more ‘prestigious’ firms have, in some cases, felt the need to tweak their business models and focus in order to fight off the improved competition. 20 years ago, bright and ambitious graduates joined a ‘Tier 1’ to sit next to CEOs and talk about Strategy. Nowadays these brands still have access to the same boardrooms but the topics range from Strategy to Risk, from HR to Finance and as time goes on, the battle for the middle ground will continue to gather pace.

Moving now to the final point, on resourcing models. Long has the flexible working model existed in professional services, initially in the legal sector and subsequently the consultancy sector, but never before has it gained as much momentum as we are currently seeing. When I did my first business school presentation to MBA students around 5 years ago, the majority of the Q&A session was focused on how to get into McKinsey etc, whereas at INSEAD last year, I can safely say that a significant portion of the questions were geared towards independent consulting – ‘what could I charge as a day rate after 3 years at Bain?’, ‘how does one go about building their own relationships in order to attract independent work?’. This highlighted to me a new breed of Consultant, a Consultant who no longer accepts the archetypal view that in joining a global consultancy firm, sacrifices will be made on family life, body clock and personal time, instead the rise of the interim consultant who supports the view of a virtual bench, a high impact approach and a short term, high intensity and cost effective model which is mutually beneficial for the client (note the first point on client demands) and the consultant. Some of the larger Consultancy firms have embraced this – Deloitte have set up ‘D.O.T’ or ‘Deloitte Open Talent’ to ensure that a one-size fits all resourcing model isn’t impacting their ability to hire the best people in the market. This is absolutely something we expect to continue.

In summary, without mentioning digital disruption, AI, Robotics, and numerous other trends which are impacting the Consultancy sector, it is clear that the Consultancy market has changed and will continue to change in order to stay relevant. Investigo’s Consultancy team has supported an impressive client base for 10 years now and as the team goes from strength to strength, we would love to hear from you if you have any comments on the above or would like to explore any of the above points further.

To conclude with a well-used phrase, which feels very appropriate, it’s time to Change or Die.

If you would like to know more about what we are doing in the consultancy market please contact Paul Mullins, paul.mullins@investigo.co.uk